This week, I was in the district to host my first two events! Next week, we are back to business in Springfield.

SESSION

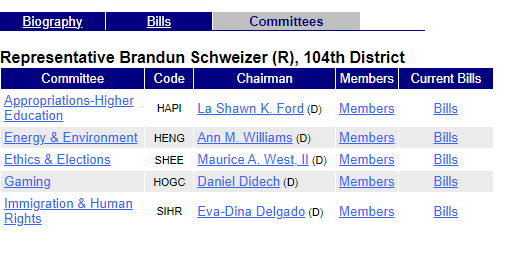

Session begins on Tuesday at noon. Committees are scheduled to meet before and after Session. I am on five different committees.

Committees serve as a defined lens to look at a bill. Legislators file a bill, bills are referred to the Rules Committee, and then, if the legislation passes the Rules Committee, it is turned over to a standing committee that is specifically tailored for certain pieces of legislation. There is a small group of legislators on each committee, and they then talk through the bill, list the pros and cons, hear testimony in the form of proponents and opponents, make changes to the committee, and ultimately pass it to the House Floor for votes from all House colleagues.

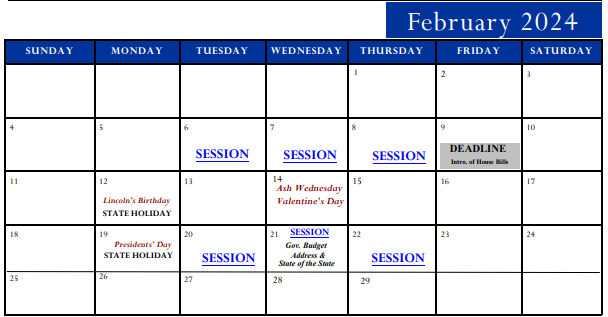

The House is scheduled back on Tuesday, February 20th. To watch the House Floor live, visit the Illinois General Assembly website, and click “Audio/Video”, which is nested under “House”. The schedule for Session is also available under “Schedules”, nested under “House”.

On Wednesday, February 21, coming together for a joint Session, Governor Pritzker will address the General Assembly with the Fiscal Year 2025 State of Illinois Budget.

BUDGET

House Minority Leader Tony McCombie and Republican Budgeteers discussed their priorities for the Fiscal Year 2025 State Budget at a press conference in Leader McCombie’s Capitol office last Thursday.

As the General Assembly begins a new legislative session and looks ahead to the Governor’s budget address next week, the Republican leaders wanted to set the stage for what they expect to be included in the upcoming FY25 budget proposal.

Leader McCombie outlined the House Republican priorities for the year:

- Holding the majority party accountable to spending

- No New Taxes – Illinois voters rejected a graduated income tax in 2020. We need to provide meaningful tax relief to Illinois residents.

- Tackling the State’s $141 billion pension debt

- Fixing state agency mismanagement and disfunction

- Meeting our prior fiscal obligations

- Real Ethics Reform – The federal corruption trials and convictions of the ComEd Four, former Madigan Chief of Staff Tim Mapes, former Chicago Alderman Ed Burke, and the upcoming trial of former House Speaker Michael J. Madigan should instill action in the majority party to work with Republicans on meaningful ethics reform proposals.

- Properly funding education via the evidence-based model

- Prioritizing state services for Illinois citizens

Norine Hammond, Deputy Republican Leader and chief budgeteer for the House Republicans, pointed out that just two weeks ago, Republicans joined with Democratic colleagues in bipartisan support of a plan to protect family farms by changing Illinois’ burdensome estate tax. This effort underscores that we can work together across the aisle to advance meaningful improvements to our tax and budgetary policies.

Amy Elik, Assistant Republican Leader and deputy budgeteer, discussed her legislation, House Bill 4998, to provide tax relief to Illinois families.

CGFA: INCOME TAX RECEIPTS DOWN IN JANUARY

The numbers, which reflect State tax revenue intake, were published in the “Monthly Briefing” published by the General Assembly’s Commission on Government Forecasting and Accountability (CGFA) as tracking of State revenues in January 2024. Although the U.S. economy continues to be strong nationwide, payment of income tax to the Illinois Department of Revenue (IDOR) dropped significantly in January 2024. Relative to the prior year, personal income taxes paid to IDOR were down $52 million from the previous year, and corporate income tax payments were down $15 million, creating a total income tax shortfall of $67 million.

Although State sales tax receipts rose $16 million during the same period, the income tax shortfall was decisive in producing overall negative revenue trend numbers for January. Across all general funds tax lines, State of Illinois January 2024 revenues were down $22 million from the year-earlier month. This cash flow number marks what could be a significant negative turnaround from the generally positive numbers chalked up by IDOR during the first half of FY24. During this period, Illinois income tax revenues and overall tax revenues posted a series of numbers that were able to keep up (just barely) with the swelling spend rates of the State as authorized by the Democrats’ FY24 State of Illinois Budget.

GOVENOR TO DELIVER BUDGET ADDRESS AND STATE OF THE STATE ADDRESS NEXT WEEK

The Illinois State Budget for Fiscal Year 2025 (that will begin on July 1, 2024) will be a major challenge for the State. With spending already bumping up against the limits of current state revenue, the budget for the current FY24 fiscal year (ending June 30, 2024) is barely balanced at best. More accurate figures point to Illinois running a “hidden” current deficit of as much as $890 million, a gap met by slow-paying bills and by dipping into one-time cash sources. Furthermore, the nonpartisan Commission on Budget Forecasting and Accountability (CGFA) is now seeing current declines in key State tax revenue streams such as the income tax. These facts are in front of Gov. Pritzker and his aides as they prepare the Governor’s budget address to be delivered to a joint session of the Illinois General Assembly on Wednesday, February 21. With Springfield spending already up to and matching current and potential future State revenues, Illinois cannot afford to add new spending programs for FY25.

House Republicans have taken the lead as they urge spending restraint. Illinois continues to have one of the lowest credit ratings of any of the 50 states, and charges along the highest per-capita tax loads. Illinoisans must pay property, income, and sales taxes to their State and local governments, and comparable government services cost more in Illinois than they do in most other U.S. states. At the same time, however, advocates and lobbyists continue to demand more money to be spent on existing programs, or to create new ones. These could quickly become voices for even higher Illinois tax rates, or for the creation of entirely new taxes.

GUNS

The Protect Illinois Communities Act (PICA), enacted in January 2023 by a lame-duck General Assembly, bans numerous semi-automatic firearms and the possession of items related to these firearms. Persons who oppose the unencumbered right to keep and bear firearms call the PICA-banned firearms “assault weapons,” and the items banned by PICA include items such as gun fixtures, gun fittings, and larger-capacity ammo clips.

Many Illinois gun owners, relying on the overall protection granted to them by the federal Second Amendment, have maintained their confidence that the new law would be struck down. The Illinois State Police has created a webpage so that gun owners can register their priorly-possessed firearms and items that will be banned going forward, but many Illinois gun owners appear to have boycotted the registration process. At the same time, several gun rights advocacy groups have begun to take legal action against the controversial new law.

Petitions filed this week with the United States Supreme Court formally ask that previous court decisions that have upheld the gun ban law be reversed and that the law be struck down. The plaintiffs have begun to cite prior decisions from the nation’s highest court, handed down in other cases, that have generated precedents in favor of gun rights. As this case moves forward, interested parties can “amicus curiae” briefs on the PICA case that will set forth more precedents and arguments. The U.S. Supreme Court has the power to strike down the Illinois law as unconstitutional.

IMMIGRATION

This week, Governor JB Pritzker and Cook County Board President Toni Preckwinkle announced their plan to spend a combined $250 million in state and local funds on additional aid to deal with Chicago’s migrant crisis.

In November, Gov. Pritzker committed an additional $160 million in state funds to the migrant crisis response. That commitment was in addition to the $478 million the State has already spent since the start of the migrant crisis. As part of the new joint funding plan, Pritzker intends to spend an additional $182 million, which will be part of the Governor’s upcoming Fiscal Year 2025 budget proposal to the General Assembly.

Cook County has already committed more than $100 million in its current FY24 budget for migrant-related costs, primarily for healthcare, and President Preckwinkle stated her intent to commit up to $70 million more for this joint funding plan. This plan will maintain shelter capacity as well as the continuation of wraparound and healthcare services. More than 35,000 migrants have arrived in Chicago and its suburbs over the last year and a half.

State, county and city officials project $321 million is needed to keep the migrant operation — including the city’s costly shelter system — afloat through the end of 2024, according to the governor’s office.

The City of Chicago, under the terms of the joint funding plan, was supposed to provide an additional $70 million to cover the remaining gap in the $321 million total cost for migrant services. However, Mayor Brandon Johnson appeared to renege on that pledge during a press conference held after the City Council’s meeting on Thursday.

Altogether, Governor Pritzker has committed $820 million in Illinois taxpayer funds to address the migrant crisis in Chicago.

TAXES

At a press conference in Springfield last week, Rep. Dan Ugaste and Rep. Tim Ozinga announced a plan to combat opportunity deserts and provide solutions to high property taxes that are impacting many of Illinois’ most economically fragile citizens. Also participating in the press conference was former state representative Mark Batinick.

Opportunity deserts in the state are often created when high property taxes have driven out existing businesses and/or inhibited commercial growth. When this occurs, a vicious economic cycle is created that puts a larger tax burden on existing homeowners. And those who most often feel the larger tax burden are seniors, the unemployed, under-employed, poor, and minorities.

Two Illinois towns in Cook County offer prime examples of a huge disparity in property tax rates. In Winnetka, the average household income is $400,000 and the racial makeup includes only 1.8 percent Black or Latino. The commercial property tax rate there is 7.465 percent. By contrast, in Harvey, the average household income is $41,000 and the racial makeup includes 92 percent Black or Latino. The assessed property tax rate there is nearly four times higher at 28.579 percent.

House Bill 4866, filed by Rep. Ozinga and co-sponsored by Rep. Ugaste, would establish an annual program to award property tax relief swaps to school districts in the state. The Fixed Pension Payment Property Tax Relief Plan would tie pension costs and property tax relief into a certain percentage of each year’s budget. And with pension costs going down as a percentage of the overall budget in the coming years, a pool of resources would be created to provide school districts with funds that in turn lower their property tax levy. Once fully implemented, some districts could see a 50 percent reduction in their property tax levy.

Property tax relief leads to organic growth and a way out for areas with opportunity deserts. Illinois House Republicans look forward to working with Democrats to implement these solutions to help provide relief for homeowners and property owners in our state.

TAX FILING TIME APPROACHES

Many Illinois residents are already taking steps to file their 2023 State income tax returns. Prompt filing, especially electronically, speeds up payouts of income tax refunds. State income tax law has many similarities with the federal income tax and almost all filers start by calculating their federal adjusted gross income. They then make adjustments to match their top line with the different numbers allowed under State of Illinois tax law.

The Illinois Department of Revenue (IDOR) is working in affiliation with several other entities, including the federal Internal Revenue Service (IRS) and the AARP Foundation Tax-Aide Program, to point Illinois taxpayers toward help in filling out and filing their tax returns. Many Illinoisans, especially senior citizens, qualify for assistance programs oriented toward electronic filing of basic income tax returns. Tax Day is Monday, April 15, 2024.

Information specific to District 104 is available on my page. Information for veterans, low income, and tax locator services is available there.

HOUSE BILL 4972

Last week, I filed House Bill 4972. The bill requires the Central Management System, the state agency responsible for handling health insurance and benefits for Illinois state employees and retirees, to give 120 day notice prior to any changes taking effect concerning health insurance and coverage. The bill was filed after retired Rep. Mike Marron started the process while in office, after the State of Illinois wanted to implement Aetna as the sole insurance option for Medicare, which Carle Hospital of Champaign did not accept at the time. I released a press release about filing the legislation.

OTHER NEWS: IN THE DISTRICT

SCHOLARSHIP OPPORTUNITIES

In Illinois, there are a lot of opportunities for high school seniors to apply for scholarships to go toward college tuition in the Fall. On my website, there is a tab named “Resources” with scholarship opportunities listed, with their respective links. As more applications open, I will update the tab. Stay up to date by visiting my website at, https://repschweizer.com/.

AMBER GLEN- COFFEE, CONNECTIONS & CONVERSATION

Thank you to Amber Glen for hosting Coffee and Connections! Here my office was invited to Amber Glen Alzheimer’s Special Care Center in Urbana to talk about new legislation that is specific to the industry. It was a great experience and learning opportunity to hear about the needs of the industry.

OPEN HOUSE

Thank you to everyone who came out to the open house! We had a great turnout. I am eager to work with all of you going forward.

VALENTINES FOR VETERANS CARD DROP OFF AND DELIVERY

Our office had an overwhelming amount of donations of valentines that we were able to hand deliver to veterans living at Cannon Place. A big thank you to DHS’s Future Problem Solvers for pairing with Sen. Faraci’s and my offices to bring valentines, chocolates, and food pantry donations to Cannon Place and to Melissa Thomas at Cannon Place for organizing the event.

MONDAY, FEBRUARY 19TH IS PRESIDENTS DAY

On Monday, our offices will be closed for Presidents Day. Our Rantoul and Danville locations will be open Tuesday, from 8 a.m.- 4 p.m., and our Springfield location from 8:30 a.m.- 4:30 p.m.